Role of Microfinance in the Socio Economic development of Women

Keywords:

Financial inclusion, inclusive growth, poverty reduction, micro-finance and micro-credit programs, women and micro-finance, woman empowermentAbstract

With financial inclusion emerging as a major policy objective in India, the abolition of the rural –urban divide and the inclusive growth of citizens of India can be achieved by providing finance to people when they require it. Among the policies related to poverty reduction, microfinance and microcredit programmes occupy a central position. Rural microfinance has occupied center stage as a channel for extending financial services to unbanked segments of the population. The objective of offering women the access to microfinance services is that gender inequalities inhibit economic growth and development. There is a growing appreciation of the “empowerment” dimension of finance, as it can give ordinary people and the poor access to opportunity. As for the whole of India, and therefore in J&K, the concept of inclusiveness goes beyond the conventional objective of reduction in poverty to encompass equality of opportunity for all, as well as economic and social mobility for all with favorable action for minorities and women through promoting entrepreneurship. There must be equality of opportunity to all with freedom and dignity, and without social or political obstacles. This must be accompanied by an improvement in the opportunities for economic and social advancement. Micro finance in J&K is still in its initial stage. With J&K in the lowest position of microfinance penetration intensity, measures have to be taken to increase this level of penetration for a better economic scenario. Efforts towards reduction in social and economic disparities can work as a prospective catalyst for the smooth transition of J&K into an economically better state. In particular the females in J&K should also be provided special opportunities for developing their skills, building social & human capital through increase of intangible assets like self respect, self esteem, self confidence, trust and positive attitude change & thus ensuring inclusive growth. The emphasis of this paper is that microfinance needs to be designed not as an economic model but as a holistic approach towards the growth of J&K.

Downloads

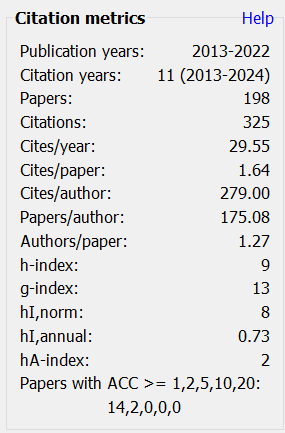

Metrics

References

Microcredit Summit Campaign (2000) Empowering women with microcredit: 2000 Microcredit Summit Campaign Report. Washington, DC. www.microcreditsummit.org/pubs/reports/socr/2000/report00.html.

Mayoux, L. (2006) Women’s empowerment and microfinance: A ‘think piece’ for the microfinance field. Sustainable Micro-finance for Women’s Empowerment. www.genfinance.info/.

Jayasheela, Dinesha P. T., and V. Basil Hans, (2006). “Financial Inclusion and Micro-Finance in India: An Overview”, http:// www.ssrn.com.

Mauldin, Caroline, (2008). “Center for Financial Inclusion Will Advance Commercial

Microfinance While Ensuring Interests, Needs of Poor Households”, Centre for Financial Inclusion at ACCION International, Washington, D.C, September, 18,

http://www.centerforfinancialinclusion.org.

Jha, Abhas Kumar, (2000). “Lending to the Poor- Design for Credit”, Economic & Political Weekly, February 19-26, pp. 606-609.

NABARD annual report 2010-11

Reddy A.Amarender and Malik Dharm Pal, 2011. “A review of SHG- Bank linkage program in India”, Indian Journal of Industrial Economics and Development, Volume

7 No. 2 (2011): 1-10

Sanyal, P. (2009) From credit to collective action: The role of microfinance in promoting women’s social capital and normative influences. American Sociological

Review 74: 529-550.

Kulkarni Vani S., 2011. “Women’s empowerment and microfinance”, thirteenth discussion paper the Asia and the Pacific Division, IFAD.

Sharma Ankita 2012. “Impact of Microfinance on Human Capital Development of Rural Women in District Udhampur-J&K”, International Journal of Retailing & Rural

Business Perspectives Volume 1, Number 1, July –Sept.

Kato Mushumbusi Paul & Kratzer Jan , 2013. “Empowering Women through Microfinance: Evidence from Tanzania”, ACRN Journal of Entrepreneurship

Perspectives Vol. 2, Issue 1, p. 31-59, Feb. 2013 ISSN 2224-9729.

Garikipati, S. (2008). The Impact of Lending to Women on Household Vulnerability and Women’s Empowerment: Evidence from India. World Development, 36(12),

2620–2642.

Swain, R. B., & Wallentin, F. Y. (2009). Does microfinance empower women? Evidence from self?help groups in India. International Review of Applied Economics,

23(5), 541–556.

Hunt, J., & Kasynathan, N. (2002). Reflections on microfinance and women's empowerment. Development Bulletin, 57, 71–75.

Khan, R. E. A., & Noreen, S. (2012). Microfinance and women empowerment: A case study of District Bahawalpur (Pakistan). African Journal of Business Management,

6(12), 4514–4521.

Vengroff, R. & Creevey, L. (1994). Evaluation of Project Impact: ACEP component of the community enterprise development project (Report to USAID/Dakar). Storrs.

Goetz, A. M., & Gupta, R. S. (1996). Who takes the credit? Gender, power, and control over loan use in rural credit programs in Bangladesh. World Development, 24(1),

45–63.

Rahman, A. (1999). Micro-credit initiatives for equitable and sustainable development: Who pays? World Development, 27(1), 67–82.

Khan, M. R., Ahmed, S. M., Bhuiya, A., & Chowdhury, M. (1998). Domestic Violence against women: Does development Intervention matter? Dhaka: BRAC-ICDDR, B

Joint Research Project.

Kabeer, N. (2001). Resource, Agency, Achievements: Reflections on the measurement of women's empowerment. In A. Sisask (Ed.), Sida Studies No. 3. Discussing Women's Empowerment: Theory and Practice (pp. 17–57). Stockholm: Novum Grafiska AB.

Malhotra, A., & Schuler, S. R. (2005). Women's Empowerment as a Variable in International Development. In D. Narayan (Ed.), Measuring Empowerment: Cross- Disciplinary Perspectives (pp. 71–88). Washington, DC: The Word Bank.

Lodhi Elahi Toheed, Luqman Muhammad, Javed Asif and Asif Muhammad , 2006. “Utilization of Micro-credit by the Female Community: A Case Study of Azad Jammu

and Kashmir (Pakistan)” International Journal Of Agriculture & Biology, vol. 8, No.2

Khaki Audil Rashid & Sangmi Mohi-ud-Din (2012) “ Microfinance and Self- Help Groups: An Empirical Study” Indian Journal Of Management Science (IJMS) Vol. II,

Issue: 2, September. ISSN 2231-279X

Downloads

Published

How to Cite

Issue

Section

License

Revised Copyright/CC license that applies to all the articles published after 05-02-2017

Attribution-NonCommercial 4.0 International (CC BY-NC 4.0)

Copyright/CC license that applies to all the articles published before 05-02-2017

Attribution-Non Commercial-No Derivatives 4.0 International (CC BY-NC-ND 4.0)

Author(s) will retain all the right except commercial and re-publishing rights. In the case of re-publishing, they will have to obtain written permission from the journal. Additional licensing agreements (Creative Commons licenses) grants rights to readers to copy, distribute, display and perform the work as long as you give the original author(s) credit, they can not use the works for commercial purposes and are not allowed to alter, transform, or build upon the work. For any reuse or distribution, readers and users must make clear to others the license terms of this work. Any of these conditions can be waived if you get permission from the copyright holders. Nothing in this license impairs or restricts the authors’ rights. To view a copy of this license, visit http://creativecommons.org/licenses/by-nc-nd/4.0/ or send a letter to Creative Commons, 171 Second Street, Suite 300, San Francisco, California, 94105, USA.

Research Papers published in SOCRATES are licensed under an Attribution-NonCommercial-NoDerivatives 4.0 International (CC BY-NC-ND 4.0)